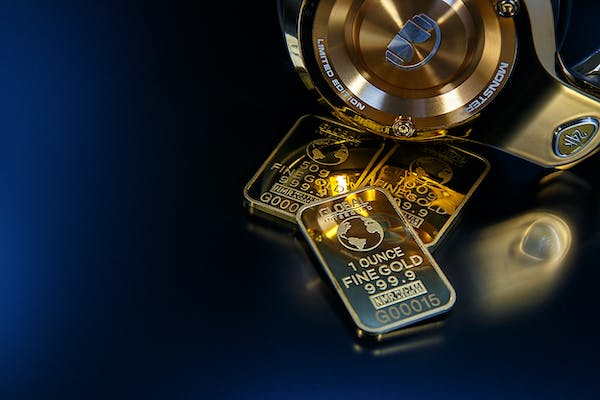

Gold Individual Retired Life Accounts (Gold Individual retirement accounts)

Provide distinct benefits and furthermore risks compared to traditional Individual retirement accounts In this brief post, you’ll learn more regarding the gold individual pension advantages and negative aspects, just how to pick the appropriate gold individual retirement account company, and furthermore rotating techniques to purchase Gold IRA Companies to safeguard your financial future.

What is a Gold individual retirement account?

A self-directed individual retirement account, particularly a gold individual retirement account, is an individual retirement account that holds gold or to basic property or commercial buildings, such as annuities, supplies, or bonds. Gold individual retirement account is a type of self-directed IRA that allows you to purchase gold by changing your normal individual retirement account, Roth IRA, Simplified Employee Pension (SEP) approach or 401( k) to gold coins and additionally bullion.

Gold individual retirement account transfer give one-of-a-kind benefits along with dangers contrasted to regular IRAs. On one hand, they offer protection versus climbing rate of living, range of financial investment profiles, and tax benefits for retired life cost savings.

On the other hand, gold Individual retirement accounts might have particular restrictions on negotiations, storage space area and also upkeep fees, liquidity problems, along with costs for truly very early withdrawals. Permit’s take an extra comprehensive consider all the advantages and drawbacks that a gold IRA includes.

The Conveniences and drawbacks of Gold IRAs

Gold IRAs make use of a rising price of living bush, aid enhance your economic investment portfolio, and likewise consist of tax benefits. However, much like various other financial gadgets, they do have some disadvantages, such as limitations on contributions and potentially reduced returns than some numerous retired life financial investments.

If you want to open up a gold individual retirement account nevertheless do not know where to start, start by downloading an entirely cost-free gold individual retirement account introduction. This overview has whatever you require to create a gold individual. pension. It in addition consists of essential details on field frauds, the negative elements of obtaining gold, and different other important details.

Currently, permit’s discover the advantages and furthermore downsides of purchasing a gold individual pension.

Gold IRA Pros

Gold IRAs can be a beneficial renovation to your retirement planning method, thanks to their lots of advantages. Right here are the 3 major benefits of gold Individual retirement accounts.

Bush Versus Climbing Price Of Living

Amongst amongst one of one of the most substantial advantages of getting a gold individual retirement account is its capacity to shield your price financial savings from the wearing down impacts of rising price of living. Gold has in fact an enduring reputation for preserving or maybe elevating its worth throughout durations of monetary distress. As an example, throughout the 2008 home dilemma, the well worth of gold experienced a significant increase.

By acquiring gold through an individual retirement account, you can safeguard your retired life funds from the damaging influence of enhancing expense of living and also ensure that your cost savings preserve their purchasing power gradually

Financial Financial Investment Account Diversity

A well-diversified financial investment profile is required for lowering danger and taking full advantage of feasible returns. Gold IRAs can play an essential task in acquiring this stability by giving straight exposure to a property training course that usually carries out well when normal domestic or industrial residential or commercial properties, such as.

products and bonds, underperform. One of the choices to take into account is gold backed individual retirement account financial investments, which can much better reinforce your account.

Physical gold works as a counterbalance to unsafe profiles, assisting to reduce the.

impacts of market modifications on overall monetary investments. By marking a section of your retirement expenditure financial savings to a gold individual retirement account, you can improve the basic safety of your portfolio and likewise much better setting the ups in addition to downs of the marketplace.

Tax Benefits

Gold IRAs give tempting tax obligation advantages for retired life savers. These accounts supply.

tax-deferred development, permitting you to maintain a great deal much more for retired life without enduring instantaneous tax obligation responsibility obligation. However, bear in mind that the Irs (IRS) calls for that gold held inside an individual retirement account have a minimal purity level of 99.5%. This stringent need should be satisfied to ensure the gold is qualified for an individual retirement account.

In addition to tax-deferred growth, gold Individual retirement accounts supply various other tax benefits, such as settlements made with pre-tax bucks, decreasing gross earnings, along with tax-exempt retired life distributions for Roth gold Individual retirement accounts. These tax commitment benefits can make gold Individual retirement accounts an.

eye-catching choice for optimizing your retired life savings.

Physical Possession

Unlike supplies or bonds, a gold individual retirement account stands for a concrete household or industrial residential property. There’s a fundamental worth to holding a physical product. IRS permits you to consist of gold, silver, and various other physical rare-earth elements like platinum and palladium into your individual retirement account.

Gold Individual Retirement Account Cons

While gold Individual retirement accounts provide various benefits, they in addition include details. Drawbacks that you need to think about prior to investing.

We recommend that you download our cost-free gold individual retirement account guide. It’s loaded with beneficial information relating to the possible benefits of obtaining gold for retired life, the potential.

downsides, in addition to a great deal a lot more.

Settlement Limitations

Gold IRAs have annual negotiation limitations that can restrict the amount you can invest in rare-earth elements. For individuals under the age of 50, the settlement restriction for 2023 is $6,500, while those over the age of 50 could make an included catch-up settlement of $1,000.

Nonetheless, it is essential to keep in mind that there is no constraint on the quantity that can be quit from an additional individual retirement account right into your gold individual retirement account. This advises that if you currently have an existing 401( k), traditional or Roth IRA, you can move funds from that account right into a gold individual retirement account without being subject to the annual contribution restrictions.

Storage space Area along with Upkeep Expenses

Gold IRAs demand physical storage room at a licensed safe, which might maintain higher prices than those pertaining to normal Individual retirement accounts. Storage space, insurance coverage, in addition to constant account maintenance charges might use, including in the overall expenditure of protecting a gold individual pension.

Some circumstances of IRS-approved vaults contain:

- Delaware Safe Option Company.

- Edge’s Global Solutions.

- International Safe Providers.

- JPMorgan Chase.

- HSBC Financial institutions.

- CNT Safe.

These firms make use of secured custodial treatments to financial institutions. When purchasing a gold individual retirement account, it’s essential to carefully think about the connected prices and likewise select a trusted depository to see to it the defense of your gold individual retirement account financial investment.

Liquidity Problems

Offering physical gold can be much more challenging than marketing paper structures, probably affecting your capacity to accessibility to funds quickly. The possible dangers gotten in touch with limited liquidity contain the difficulty of advertising and marketing gold financial investments in a prompt style and in addition the ability for cost volatility.

Additionally, the worth of gold may experience substantial fluctuations with time, troubling to plan for the well worth of your gold investments. This possibility for volatility highlights the relevance of taking into consideration liquidity issues when purchasing a gold IRA.

Early Withdrawal Penalties

Obtaining funds from a gold individual retirement account before the age of 59 1/2 may produce a 10% penalty, along with tax obligation responsibilities on the taken out amount. This can be a significant economic trouble for those that requirement to access their retirement funds extremely early as a result of unanticipated situations or emergency situations.

Nonetheless, it is necessary to bear in mind that these fees are suggested to inspire lasting retired life economic cost savings and in addition dissuade incredibly very early withdrawals. By extremely carefully planning your financial investments together with preserving an emergency fund different from your gold IRA, you can protect versus the requirement for actually very early withdrawals and the linked charges.

Select the Right Gold Individual Retirement Account Organization

Picking the ideal gold individual retirement account firm is an essential activity in safeguarding your monetary future. In this field, we’ll analyze the variables you need to consider when checking out gold individual retirement account firms.

By diligently checking out together with contrasting gold individual retirement account organization you can make sure a smooth and safeguarded monetary financial investment experience.

Judgment

To evaluate the performance history of a gold individual retirement account company, think about variables like consumer endorsements, field honors, and in addition the dimension of time the firm has actually remained in service. When examining client support, search for the ease of gain access to of customer service agents, the comments time, and additionally the premium of the client care offered.

Finally, examine the prices gotten in touch with establishing together with keeping the account, along with the type of economic investments used.